hey I have a new label I'm starting would love to sit down with you and talk about it...

hey I have a new label I'm starting would love to sit down with you and talk about it...We are working on bringing in some outside resources to help spur the growth of the Bodega. It is a learning process that is definitely helping me sharpen my sword. It is also opening up my eyes to different perspectives on this fine business we are all in.

A couple weeks ago I went to seminar on entrepreneurship sponsored by alma mater, UVa. One of the leaders was a guy who specialized in acquisitions and turnarounds. The other was a former venture capitalist (VC). The VC cat ran a session on fundraising which was really why I was there although I learned so much more.

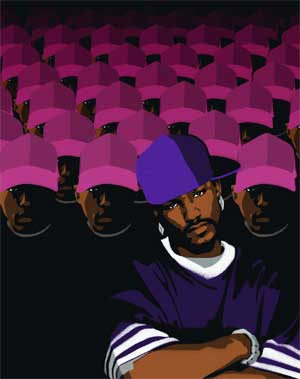

The VC was trying to show us how the other side of the table looks at our situation. As the discussion rolled on I realized that the VC could have been Jimmy Iovine or Barry Weiss. And the audience could have been a room full of artists. Most record labels are fundamentally venture capitalists and artists are entrepreneurs with little or no funding.

Looking at the industry with these eyes will prevent a lot of heartache on the artists' part and may actually help the old guard extend their life for a few years.

The lesson from this session was make sure you know who you are approaching for money. There is a big difference between friends and family, angel investors and vc's. Depending on your needs and goals is who you pick.

Friends and family will give you the best terms. VC's don't give a f&#k, they want their return. And in exchange they may want seats on the board, final say and the all important exit strategy (flipping your company or breaking it up). They are not investing because they like you they are investing so they can make their return.

Just check out these points from my notes and tell me if this sounds familiar:

· VC’s will invest in a business just so another fund doesn’t snap it up

· Out of several thousand business plans they see a year they invest in less than one hundred

· This cat only invested in businesses where he could get a 10x return in five years or less

· He urged entrepreneurs to ask the fund managers what deals they had done in the past year because many VC firms have no track records. “They are living off of one lucky deal."

· Don’t take funding from a VC who has been around for 8 years. Most funds have a 10 year life span. The cat who does your deal could be out the door by the time your product comes to market.

Had my head spinning.

I don’t want to beat you guys in the head about this but the other professor also made some interesting points. He specialized in buying failing or underperforming businesses. He trimmed the fat, repositioned the company, fired some people and turned a profit. (Reminded me of Koch. BTW, 50’s graveyard comment is completely relative. I think Koch has a great business model. One person’s graveyard is another’s sanctuary.)

We were talking about how do you assign value to your company and distribute equity. How much equity does money buy? How much equity does sweat buy? Know-how? Connections? Etc. The professor stood up and said “100% of the money buys 100% of the equity. All negations begin there. I value the sweat but don’t talk to me about getting 51% without some money.”

I think this is another great lesson for artists. Walking into a negotiation with a label, manager, or distributor without a monetary investment weakens your position. You can’t get a lion share of the profit without taking the lion share of the risk. And anyone who gives you such a deal may not be the best person to be in business with. Having a minority stake in Def Jam Enterprises is better than a majority share of Death Row. Who the money comes from is just as important as how much.

Labels: hip hop, music business